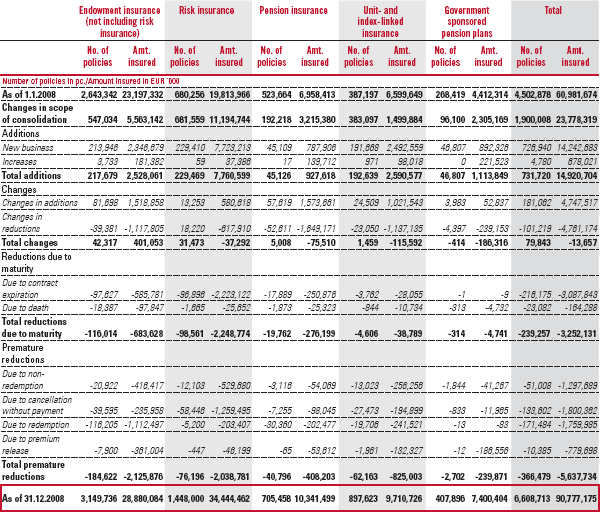

The following table shows the change in holdings of endowment insurance (not including term insurance), term, pension, and unit- and index-linked insurance, government-sponsored pension plans, and the total of these amounts.

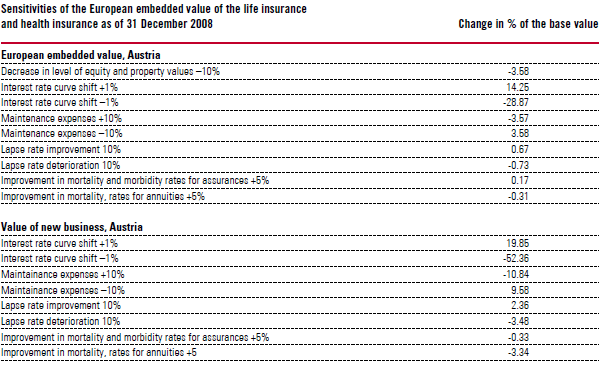

European Embedded Value sensitivity analysis for the life insurance business

The embedded value is determined in accordance with the Market Consistent Embedded Value Principles published by the CFO Forum on 6 April 2004, and will be published separately on 31 March 2009.

The embedded value consists of two components: the adjusted net assets at market value and the value of the insurance portfolio, which equals the cash value of distributable after-tax profits minus the capital commitment cost of the solvency capital. Thus, embedded value is an actuarial valuation of the value of a company, assuming the continuation of current operations (going concern), but explicitly excluding the value of future new business. In addition to the embedded value, the increase in value brought about by new business written during the reporting period is also determined.

The estimated trend of future profits is based on “best estimate” assumptions, i.e., a realistic assessment of economic and operational conditions based on future expectations and historical data, in which future risk is taken into account using stochastic models and an explicit calculation of capital commitment costs.

When calculating the embedded value, numerous assumptions are made about operational and economic conditions, as well as other factors, some of which lie outside of the control of the Vienna Insurance Group. Although the Vienna Insurance Group considers these assumptions sound and reasonable, future developments may differ materially from expectations. Publication of the embedded value is therefore no guarantee or commitment that the expected future profits on which this value is based will be realised in this fashion.

The shareholder margin is calculated taking into account surpluses from all available income sources, with the profit participation regulation promulgated on 20 October 2006 being taken into account in the life insurance class for Austria. For the other sectors and markets, the amount of profit sharing assumed is based on local practice and the relevant regulatory rules.

The projections of future profits are based on realistic assumptions for investment income, inflation, costs, taxes, cancellations, mortality, illness and other key figures, such as changes in health-care costs and future premium increases.

The interest rate curve used depends on an assessment of the risks associated with the ability of future profits to be realised. In order to be able to make a statement on the impact of alternative interest rate curves, the embedded value as of 31 December 2008 and the increase in value resulting from new business in 2008 were calculated using an interest rate curve alternately increased and decreased by 1%.

Internal sensitivities are shown in the following table: