The Group invests in fixed-interest securities (bonds, loans/credits), shares, real estate, equity interests, and structured investment products, taking into account the overall risk position of the Group and the investment strategy provided for this purpose. Within the risk limits, the Chief Investment Officer of the Vienna Insurance Group implements the strategy decided on by the strategic investment committee. When determining exposure volumes and limits, the risk inherent in the specified categories and the market risks are of fundamental importance. The capital investment strategy is laid down in the form of investment guidelines, compliance with which is continuously monitored by the central risk controlling and internal audit departments. Investment guidelines are laid down on a centralised basis and are mandatory for all group companies, with a distinction made between investment strategies for Austria, the CEE region and Germany.

The investment strategy for Austria can be summarised as follows:

- Vienna Insurance Group practices a conservative investment policy designed for the long-term.

- Vienna Insurance Group focuses on its asset mix as a way to ensure that cash flows match its long-term liability profile and to create sustainable increases in value through the use of correlation and diversification effects of the individual asset classes.

- Investment management depends on the asset class in question or on the orientation within asset classes, whether performed internally or by an outside manager. Decisions in this regard are made by a committee set up for this purpose.

- Management of market risk on securities is aimed at providing a transparent view of the risk exposure arising from price, interest-rate, and currency fluctuations as they affect profitability and the value of securities investments, and at limiting these risks. Risks are limited by setting position limits and by means of a two-tier limit system for risk exposure.

- Market developments are monitored continuously and the allocation of portfolio assets managed actively.

About 64% of Vienna Insurance Group’s investment portfolio consists of direct holdings of fixed-interest securities and loans. Direct holdings of shares and real estate amount to 3% and approximately 13%, respectively, in each case valued by the book value of the total investment portfolio.

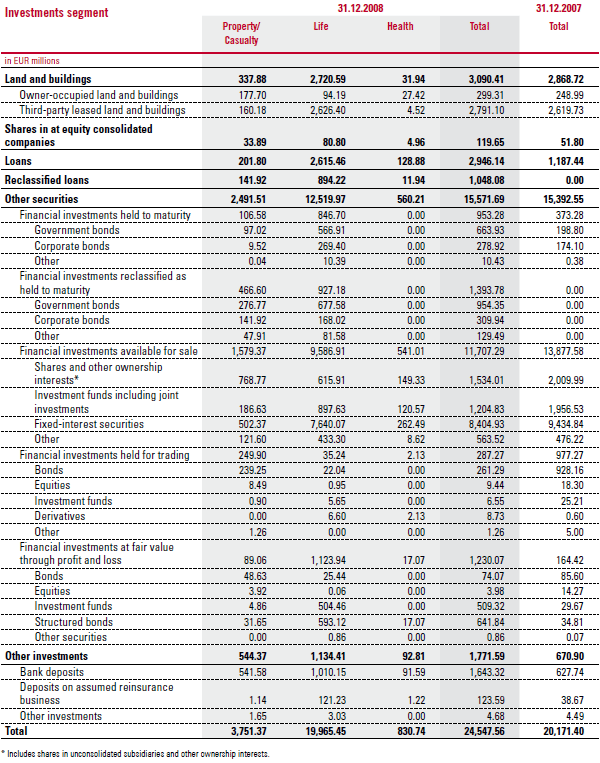

The table below shows the breakdown of the Vienna Insurance Group’s investments as of 31 December 2008 and 31 December 2007, in EUR millions, broken down by property and casualty, health, and life insurance segments: