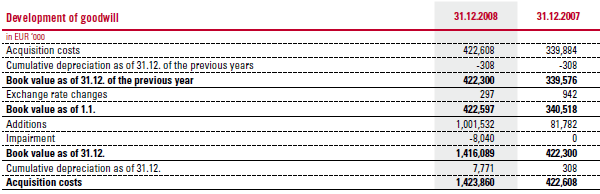

The change in goodwill is primarily due to the acquisition of the subsidiaries indicated in the section “Reporting entity and methods of consolidation”. EUR 780,793,000 of this amount is attributable to the s Versicherung Group and EUR 208,200,000 to Asigurarea Romaneasca - Asirom S.A. Vienna Insurance Group.

Information on the assumptions used in impairment testing is provided under “Impairment” in the “Summary of significant accounting policies” section.

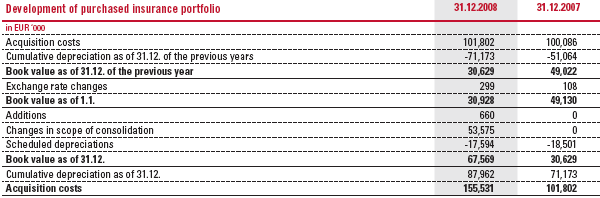

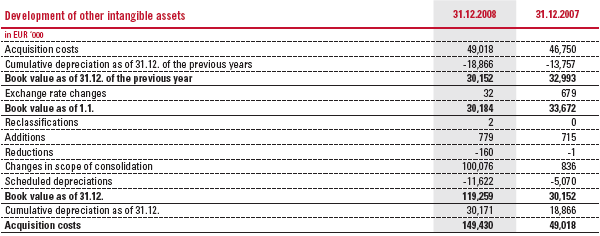

The purchased insurance portfolio results from the acquisition of existing portfolios and the securities acquired as part of the acquisition of the insurance companies described in the section “Scope and methods of consolidation”.

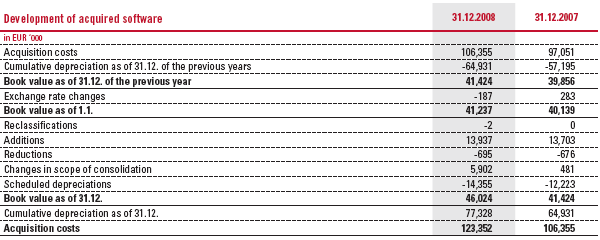

Amortisation of intangible assets is reported in the income statement under commissions and other acquisition costs and under administrative expenses.

The effects of changes in scope of consolidation structure primarily result from a trademark with an indefinite useful life (EUR 70,000,000).

Information on the determination of fair value is provided in the “Summary of significant accounting policies” section.