Central and Eastern Europe is and will remain the regional focus of Vienna Insurance Group. VIG is operating in an economic area that is expected to show increasing demand for insurance solutions and many economic opportunities for decades to come. More than 200 million people live in this region, many of whom are not yet insured, or are underinsured.

Consolidate market leader position in Austria

The roots of Vienna Insurance Group lie in Austria. The Group's history in the insurance business now reaches back approximately 190 years. Even though the long-term outlook for growth is many times greater in other VIG markets, Austria continues to be an attractive market in the 21st century. The Austrian insurance market still has growth potential compared to other Western European countries, particularly in life insurance. Its insurance density and ratio of insurance premiums to gross domestic product, two indicators for the development status of a country's insurance market, are considerably lower than the EU-15 average.

Vienna Insurance Group’s goal in Austria is to maintain and further consolidate its leadership position. In order to achieve this goal, it is important to identify social trends quickly, and react with appropriate basic and supplementary solutions. The Austrian Group companies have shown repeatedly in previous years – for example, by pioneering in nursing care insurance – that they are capable of achieving this goal.

Further growth in the CEE Region

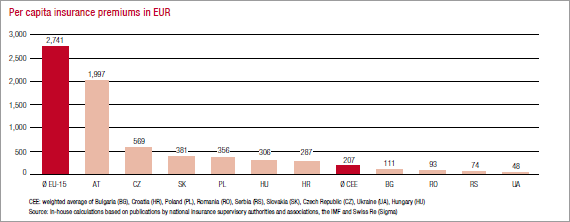

Vienna Insurance Group’s entry into Central and Eastern European insurance markets more than two decades ago opened up an economic area that has shown excellent growth since that time and continues to show great business potential for the future. The insurance density of selected CEE markets shows this impressively.

The enormous convergence potential of the region becomes clear when the insurance density of the CEE markets is compared to the average for the EU-15 countries. The countries of Central and Eastern Europe had an average insurance density of EUR 207 in 2010, compared to EUR 2,741 in the EU-15 countries. In the non-life sector, the value was EUR 111 in the CEE region and EUR 1,037 in the EU-15 countries, and in life insurance the ratio was EUR 96 versus EUR 1,704. This shows even more clearly the magnitude of the opportunities awaiting VIG in this economic area.

The Group aims to further expand its insurance activities in Central and Eastern Europe. Vienna Insurance Group has set itself the goal of continuing to grow faster than the market in coming years. The main component of this growth will come from existing Group companies. This does not mean, however, that VIG will not make purchases that fit well in its existing portfolio and improve its market position.

Insurance Density 2010

Strengthen market presence in the region

Vienna Insurance Group has used organic growth and acquisitions to steadily strengthen its market position in recent years and is now the largest insurance group in its ten core markets. No insurer earns a higher volume of life or non-life insurance premiums in these markets than VIG. Vienna Insurance Group is also one of the leading insurers in many markets outside these core markets. The Group’s goal in all countries is to consolidate or further improve its market position.