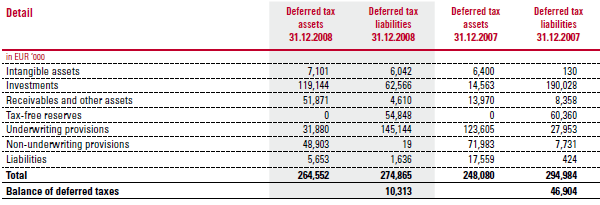

The deferred tax credits and liabilities recognised relate to the amounts of temporary differences in balance sheet items listed in the following Table. (The differences were already valued using applicable tax rates.) It should be noted that deferred taxes, as far as allowable, are settled at the taxpayer level, and accordingly differing balances are shown either as assets or liabilities on the balance sheet.