The aging of European society has direct consequences for the insurance business. The collective aging process is encountered everywhere in discussions about the future of life and health insurance.

Will the pyramid of the past become top-heavy in the future?

Longer life expectancies and lower birth rates, a shrinking population, and rising expenditures for old-age provisions, thereby placing pressure on government budgets. It is a complex subject with an interplay of many factors and many actors, and an urgent need for action.

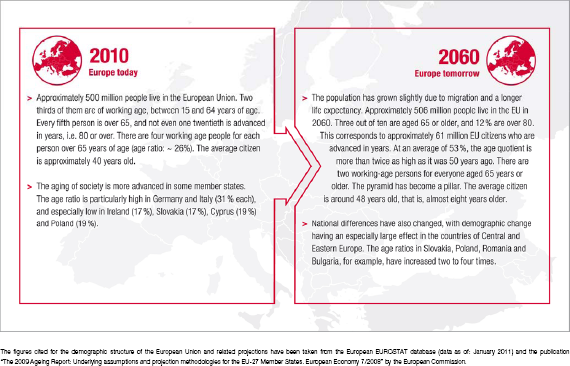

Although demographic change is not just a European phenomenon, the effects are particularly large in these societies. The countries of Europe are already practically the undisputed leaders on the list of countries with the highest rates of population aged 60 and above. Aside from small overseas territories, Japan is the only country with an older age structure. And, according to Eurostat projections, the distribution will continue to shift over the next 50 years. Grandchildren will live more than ten years longer than their grandparents in some Central and Eastern European countries. Although the birth rate will rise in almost all of the countries of Europe, it will remain below the level of 2.1 children per woman needed to maintain a constant population over the long term. Higher labour market participation rates and net immigration will only reduce the effects of a shrinking working-age population, not eliminate them completely. As a result, approximately 25 million fewer people will be in the EU workforce in 2060 than today.

The need for pension and healthcare reforms

If no changes are made to the structure of pension and healthcare systems, demographic change will cause a jump in government expenditures in most European countries. Expenditures for pensions, medical care and long-term care are rising. The expected future cost explosion is placing increasing pressure on governments to act, as the further the aging process progresses, the greater the increase in costs, and the more difficult it becomes to implement structural change.

There is no way to avoid reforms to the pension and healthcare systems, and reforms are unlikely to be successful without an increase in retirement age and indexing of benefits. Pensions will rise more slowly than wages, and the relative income of pensioners will decline significantly in many countries. In order to maintain living standards and the quality of life in old-age, private pensions will have to make up for what the government pension system can no longer provide. The share of old-age pensions provided by supplementary pension systems will rise significantly.

A similar situation also exists in the area of healthcare and nursing care. The cost of medical care is increasing, while the readiness and, in most cases, the ability to assume responsibility for providing such care decreases. Changes in family structures, greater labour force participation by women and geographical mobility allow fewer and fewer relatives to provide care for family members. Private old-age provisions will therefore also become a more important issue in terms of the potential need for care.

An aging Europe presents new challenges for insurers

Demographic change is a critical factor in the future of the life and health insurance provided by the Vienna Insurance Group. Young people in particular are already highly aware that they cannot rely on the government alone in their old age. Increasingly more not only know that they need to make provisions on their own, but are also doing so. The structural changes also bring risks for the insurance industry. As life expectancy rises, the term of insurance coverage increases, potentially making more extensive medical care necessary. The benefits paid by insurance companies rise.

Many questions still remain unanswered. Who will be able to put money aside for the future during their working lives? How healthy will we be during old age? What will technological advances bring? What direction will politics follow? It appears that demographic change will continue to be a topic of concern to the insurance industry in the future.

Boom in VIG’s private provision solutions

As the leading provider of life insurance products in the CEE region, the Vienna Insurance Group offers customers an extensive range of options for private old-age provisions. Acquisition of the s Versicherung Group and new customer-oriented products have allowed the Group to expand and strengthen its position in life insurance markets in Austria and the CEE region. Particularly high demand in 2010 caused VIG life insurance premiums to increase across the Group. Life insurance companies were also established in Macedonia and Montenegro with the goal of further participating in the long-term growth of old-age provision products in the CEE region.

The race for private health insurance in the CEE region already started in 2009 with an expansion of the products offered in the Czech Republic and Poland. Once again, the Vienna Insurance Group is one of the pioneers in a segment with great long-term business potential. It was recognised early on that old-age provision products were important not only for pensions and healthcare, but would also become increasingly more important for nursing care. Based on this belief, products of this kind are being offered by our Group companies, at the moment above all in Austria, where VIG is the clear market leader in nursing care insurance.