The insurance companies in the Vienna Insurance Group operate in the property/casualty insurance, life insurance and health insurance segments. The Group’s area of operations extends over 23 countries and is divided into the following seven geographical segments: Austria, the Czech Republic, Slovakia, Poland, Romania, Other CEE markets and Other markets.

Premiums grow to around EUR 7.90 billion

The Vienna Insurance Group generated an outstanding premium volume of EUR 7,898.87 million in 2008. This corresponds to an increase of EUR 986.94 million, or 14.3%, over the previous year. The Vienna Insurance Group retained EUR 7,041.76 million of the gross premiums written and ceded EUR 857.11 million to reinsurance companies. Major contributions to this premium growth came from high rates of growth in the CEE markets. The Czech Republic, for example, recorded a 25.6% increase in premiums and Slovakia increased its premiums by 22.5%. Poland (+46.4%) and Romania (+47.1%) were also drivers of this growth.

Overall, the Group generated around 50% of its premiums in the CEE region. In property and casualty insurance, the CEE companies even contributed 61.7% of the total property and casualty business. In the life insurance segment, 38.9% of premiums were generated in the CEE region.

Net earned premiums rose by 17.2%, from EUR 5,941.69 million in 2007 to EUR 6,961.61 million in 2008. Deferred premiums were EUR 81.28 million and deferred reinsurance cessions EUR 855.98 million.

Expenses for claims and insurance benefits

Expenses for insurance claims were EUR 5,607.36 million in 2008, after deducting the share allocated to reinsurance (EUR 606.23 million). This represented an increase of EUR 575.85 million, or 11.4%. This means that expenses for insurance claims rose more slowly than premium income relative to the year before.

Operating expenses

Total operating expenses for all of the consolidated companies in the Vienna Insurance Group were EUR 1,562.12 million in 2008, including acquisition costs and less reinsurance commissions received, which represents an increase of 16.1% over the previous year. Acquisition costs were EUR 1,375.96 million in 2008, which is an increase of 15.2% compared to 2007.

Profit before taxes increases by 23.7%

In spite of the negative factors affecting its financial result, the Vienna Insurance Group earned a profit before taxes of EUR 540.80 million in 2008. This constitutes a considerable increase of 23.7%, or EUR 103.50 million, over the profit before taxes in 2007. All business segments (property/casualty, life, health) made positive contributions to this result. Extraordinary write-downs due to negative developments in financial markets (e.g., Lehman, Iceland, etc.) were more than compensated by extraordinary income from sales (BA-CA Versicherung, Unita, various properties).

Earnings per share

Earnings per share, which is equal to the ratio of Group net profit for the year divided by the average number of shares outstanding, rose to EUR 3.41 in 2008. The increase in net profit therefore resulted in strong growth of 14.4% in earnings per share (2007: EUR 2.98). This was in spite of the additional 23 million shares issued under the capital increase carried out in the first half of 2008.

Combined ratio significantly below 100%

The Group’s combined ratio (after reinsurance, not including investment income) was 96.4% in 2008. Given the many natural catastrophes occurring throughout all of Europe (predominantly storms in 2008), this is a remarkable achievement, including in comparison to other insurance groups. In order to increase earnings power, efforts are being made to bring the combined ratio of each individual Group company significantly below 100%.

Financial result

The Vienna Insurance Group had a financial result of EUR 913.93 million in 2008. In spite of the negative effects of the international crisis, this was a drop of only 8.4%, or EUR 83.63 million, thereby confirming that the Vienna Insurance Group’s decision to follow a conservative investment policy was correct. Nonetheless, the financial crisis was not completely without effect on the Vienna Insurance Group, as extraordinary write-downs of around EUR 500 million were required in 2008. These write-offs were offset, however, by extraordinary income of around EUR 400 million.

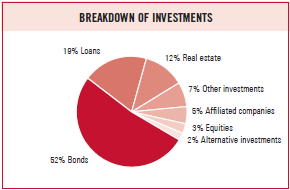

Investments nearly EUR 25 billion

The Vienna Insurance Group held investments totalling EUR 24,547.57 million as of 31 December 2008. This represented an increase of EUR 4,376.18 million or 21.7% in comparison to 2007. These investments include all land and buildings of the Vienna Insurance Group, all shares in at equity consolidated companies, and all financial instruments. They do not include unit-linked and index-linked life insurance investments, which rose 17.5%, from EUR 3,065.99 million to EUR 3,602.40 million, in 2008. Investments rose to EUR 3,751.38 million (+15.3%) in the property and casualty business, and by 24.4%, from EUR 16,047.24 million to EUR 19,965.45 million, in the life insurance business. Vienna Insurance Group´s investments in the health insurance business were EUR 830.74 million (-4.6%) as of 31 December 2008. The decrease in investments in the health insurance business was due to a regrouping of free assets.

Shareholders´ equity

The Vienna Insurance Group’s capital base was increased by 58.2% to EUR 4,138.79 million in 2008 (2007: EUR 2,615.56 million). The increase in equity resulted primarily from the capital increase carried out in the first half of 2008 and the issuing of hybrid capital.

Underwriting provisions

Underwriting provisions amounted to EUR 21,682.37 million as of 31 December 2008. This meant that the Vienna Insurance Group’s underwriting provisions were 27.9% higher than their value of EUR 17,092.13 million on 31 December 2007. Underwriting provisions rose 9.7% compared to 2007 to EUR 4,101.24 million in the property and casualty segment, 33.3% to EUR 16,776.29 million in the life insurance segment, and 4.8% to EUR 804.84 million in the health insurance segment as of 31 December 2008. Underwriting provisions of unit-linked and index-linked life insurance also increased, from EUR 2,948.52 million in 2007 to EUR 3,346.77 million in 2008, up 13.5%.

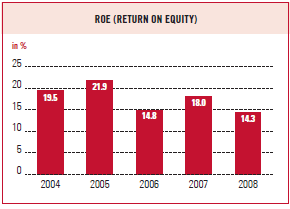

RoE (Return on Equity)

RoE describes the relationship between Group profit and the Vienna Insurance Group’s total average equity. In spite of the increase in equity resulting from the capital increase and issuing of hybrid capital in the first half of 2008, the Vienna Insurance Group achieved an outstanding return on equity (RoE) of 14.3% in 2008 (2007: 18.0%).

Cash flow

Cash flow from operating activities in 2008 rose by EUR 68.12 million, or 3.4%, to EUR 2,089.10 million. The Vienna Insurance Group’s cash flow from investing activities was EUR -3,026.60 million in 2008 (2007: EUR -1,959.04 million). The largest items in the cash flow from investing activities resulted from the acquisition of available-for-sale securities and the acquisition of fully consolidated companies and at equity consolidated companies. The Vienna Insurance Group’s financing activities produced a cash flow of EUR 1,173.69 million as compared to EUR -62.80 million in 2007. The Vienna Insurance Group had cash and cash equivalents of EUR 619.33 million at the end of 2008, and received a total of EUR 836.89 million in interest and dividends during 2008.