In the Vienna Insurance Group’s investment design, the bond segment serves primarily to ensure stable earnings over the long term. Derivatives are used to reduce investment risk. Appropriate investment guidelines expressly govern the use of derivatives for bonds managed by third parties. Unit trusts, for example, must be expressly governed by the corresponding investment guidelines.

The equity segment serves to increase earnings over the long term, provides diversification and compensates for long-term erosion in value due to inflation. The Vienna Insurance Group assesses equity risk by considering diversification within the overall portfolio and the correlation to other securities exposed to price risk.

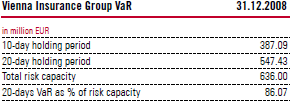

Market price risk affecting profit or loss is controlled by periodically calculating the VaR according to the “Investment and Risk Strategy – Securities” guideline for securities and adjusting it to the limit relative to the risk budget. The VaR is determined based on a daily variance-covariance calculation.The Vienna Insurance Group statistically estimates variances and covariances from market data over a 12-month period.

The Vienna Insurance Group uses a 99% confidence level. The holding period is between 10 and 20 days. Each stock’s average risk contribution is somewhat smaller than its risk yield contribution. The foreign-currency risk contribution corresponds only to a few percentage points of the overall risk.

The following table shows the Vienna Insurance Group’s VaR for available-for-sale securities:

Capital market scenario analysis

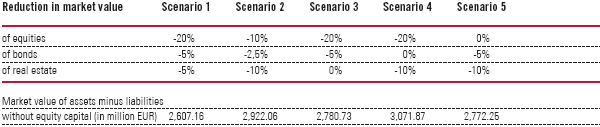

The analysis is carried out annually for all Vienna Insurance Group companies in order to check the risk capacity of the investments. The following table shows the “stress parameters” and the coverage of the solvency requirement for each scenario for 31 December 2008:

In scenario 1, the market value of equities, bonds and real estate sharply decrease at the same time. The likelihood of such an extreme scenario’s happening is very low. The market value of the assets is still considerably higher than the value of the liabilities after stress testing, which confirms the Vienna Insurance Group’s excellent rating.