The Vienna Insurance Group’s core competence is dealing professionally with risk. The Group’s primary business is assuming risks from its customers using a variety of insurance packages. The insurance business consists of deliberately assuming diverse risks and managing them profitably. One of the primary responsibilities of risk management is to ensure that the obligations assumed under insurance policies can be satisfied at all times.

The Vienna Insurance Group is exposed to a number of other risks in addition to the underwriting risks of its insurance policy portfolio. A risk management process is used to identify, analyse, evaluate, report, control and monitor these risks. The risk control measures used are avoidance, reduction, diversification, transfer and acceptance of risks and opportunities.

The overall risk of the Group can be divided into the following risk categories:

- Underwriting risks: The core business of Vienna Insurance Group is the risk transfer from the insurance holders to the insurance company.

- Credit risk: This risk quantifies the potential loss due to deterioration of the situation of a contracting party owing receivables.

- Market risk: Market risk is taken to mean the risk of changes in the value of investments caused by unforeseen fluctuations in interest rate curves, share prices and currency rates, and the risk of changes in the market value of real estate and ownership interests.

- Strategic risks: These can arise due to changes in the economic environment, case law, and the regulatory environment.

- Operational risks: These may result from deficiencies or errors in business processes, controls or projects caused by technology, staff, organisation or external factors.

- Liquidity risk: Liquidity risk depends on how good the fit is between the investment portfolio and insurance commitments.

- Concentration risk: Concentration risk is a single direct or indirect position or an associated group of positions with the potential to significantly endanger the insurance company, core business or key performance measures. Concentration risk is caused by an individual position, a collection of positions with common owners, guarantors or managers, or by sector concentrations.

As a rule, local companies in the Vienna Insurance Group are responsible for managing their own risks, while at the same time strict requirements are set in terms of investments and capital assets, as well as for reinsurance.

Effective risk and opportunities management requires ERM (Enterprise Risk Management) and a risk policy and risk strategy set by management. ERM enables managers to deal effectively with uncertainty and the risks and opportunities it involves, and strengthens their ability to create value. Taking all relevant potential future events into account improves the utilisation and proactive realisation of opportunities. Reliable information on risks improves the allocation of capital. ERM provides a procedure for identifying and selecting alternative reactions to risks.

The Vienna Insurance Group risk management department is an independent organisational unit. Every employee contributes to the effectiveness of risk management in the Vienna Insurance Group. Great importance is placed on the day-to-day implementation of a suitable risk monitoring culture. Transparent and verifiable processes form an essential element of this Group-wide risk culture. Deviations from set target values and the admission and reporting of errors can take place in our Company, and are used to promote the active problem-solving abilities of our employees.

Risk management in the Vienna Insurance Group is governed by a number of internal guidelines. Underwriting risks in property and casualty insurance are primarily managed using actuarial models for setting tariffs and monitoring the progress of claims, and guidelines for the assumption of insurance risks. The most important underwriting risks in life and health insurance are primarily biometric ones, such as life expectancy, occupational disability, illness and the need for nursing care. To manage these underwriting risks, Vienna Insurance Group has formed reserves for paying future insurance benefits.

The Vienna Insurance Group limits its potential liability from its insurance business by passing on some of the risks it assumes to the international reinsurance market. It spreads this reinsurance coverage over a large number of different international reinsurance companies that the Vienna Insurance Group believes have adequate creditworthiness, in order to minimise the risk (credit risk) due to the insolvency of one reinsurer.

The Vienna Insurance Group monitors the various market risks in its security portfolio using fair value valuations, value-at-risk (VaR) calculations, sensitivity analyses and stress tests.

Liquidity risk is limited by matching the investment portfolio to insurance commitments. Operational and strategic risks which might be caused by deficiencies or errors in business processes, controls and projects and changes in the business environment are also monitored continuously.

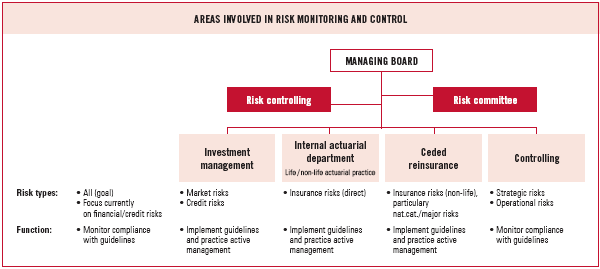

- Risk committee: The cross-class risk committee is formed by the actuarial, operations, reinsurance, internal audit and corporate risk controlling departments. The risk committee is responsible for optimisation and ongoing development of an ERM system. ERM is a framework for company-wide risk management that uses key principles and concepts, uniform terminology and clear instructions and support.

- Group actuarial department: Underwriting risks are managed by the Group actuarial department. This department subjects all insurance solutions to in-depth actuarial analysis covering all classes of insurance business (life, health, property and casualty). Stochastic simulations are performed regularly as part of the ALM process.

- Reinsurance: The reinsurance business for all Group companies is managed by the central reinsurance department established at Wiener Städtische AG.

- Risk controlling: The risk controlling department prepares a quarterly risk budget for the investment area. Budget compliance is checked weekly. Compliance with securities guide-lines and the Company’s own limit system is monitored continuously. Periodic VaR calculations and analyses and detailed stress tests are performed for this monitoring. An analysis of the Company’s risk capital model is an element of Standard & Poor’s FSR (Financial Strength Rating) for Vienna Insurance Group.

- Controlling: The controlling department monitors and controls operational developments at domestic and foreign insurance companies. This is accomplished by means of monthly reports submitted to the controlling department by the companies and an analysis of plan and forecast figures.

- Audit: The audit department systematically monitors operating and business processes, the internal controlling system of all operational corporate areas and the functionality and adequacy of risk management. The internal audit department operates continuously and reports directly to the full Management Board.

- Operations: Operations acts as an interface between the technical and claims departments and the Group’s country head offices and the external service providers in the areas of information technology and telephony. Operations is also responsible for optimisation of internal processes, strategic procurement, facility management and construction matters related to real estate occupied by the Group.