As of 31 December 2007, the Vienna Insurance Group’s real estate portfolio had a book value of EUR 2,868.7 million (market value: EUR 3,200.8 million) and a book value of EUR 2,175.6 million as of 31 December 2006 (market value: EUR 2,447.9 million). The real estate portfolio is used primarily to create highly inflation-resistant long-term positions for the insurance business, and to create silent reserves. The real estate portfolio represents approximately 14% of the total investment portfolio of the Vienna Insurance Group. To date, real estate has not represented a strategic asset class for companies in the CEE countries.

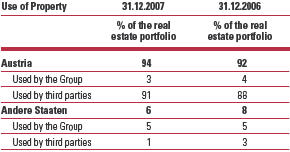

The following table shows Vienna Insurance Group real estate investments as of 31 December 2007 and 31 December 2006, broken down by location and type of use of the respective properties: